Fear #1: Is Now the Right Time to Buy a House?

This is one of the most common fears, and the simple truth is: the right time to buy is when you are ready. Here are some questions to ask yourself to determine if you are ready to make the move:

Are you tired of paying someone else’s mortgage? If you’ve been renting for years and are seeing your rent increase annually, it might be time to invest in a home of your own. Your mortgage payment, unlike rent, won’t increase over time, giving you long-term stability and peace of mind. In many cases, a mortgage payment can be comparable to or even less than your current rent.

Do you want the freedom of owning your own home? Owning a home gives you the ultimate creative control. You can choose to install a new kitchen, set up a dedicated home gym, or finally plant that backyard garden you’ve always wanted. It’s about building a life that is truly yours, without having to get permission for every change you want to make.

Do you want to build wealth? Every mortgage payment builds home equity, which is the difference between your home’s value and the amount you owe. This equity is a powerful financial tool that can be used for future renovations, to pay for other expenses, and more.

If you answered “yes” to any of these questions it might be time to make the move. Contact us to see how much home you can afford and start your journey toward homeownership.

Fear #2: Having Less-Than-Perfect Credit

You don’t need a perfect credit score to buy a house. While a higher score can get you a lower interest rate, many loan programs are specifically designed to help first-time homebuyers with less-than-perfect credit. For instance, some government-backed loans, like an FHA Loan, may only require a credit score as low as 580.

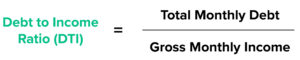

It’s also important to remember that your credit score is just one part of your financial picture. Your lender will look at your overall financial situation, including your income and debt, to determine what you can afford. If you are looking to increase your credit score before you buy, our credit specialists can help you create a personalized plan for success.

Fear #3: Not Having a Large Enough Down Payment

This is one of the biggest and most outdated myths in real estate. The idea that you need a 20% down payment to buy a home is no longer the standard. Many loan programs make homeownership more accessible than ever by requiring a much smaller down payment.

For example, an FHA Loan allows you to buy a home with as little as a 3.5% down payment. If you are a veteran or active-duty service member, you may even qualify for a VA Loan, which allows for zero down payment in most cases. Your loan officer will sit down with you to explore these options and any down payment assistance programs you may qualify for, ensuring you find a plan that works for you.

Fear #4: Making The Wrong Choice

With so many home and loan options available, it’s normal to worry about making the wrong decision. This is why you partner with a local real estate agent and a loan officer, they’re your expert team to guide you through the process and help you make the right choice for your lifestyle and budget.

- A real estate agent will help you find a home that meets your needs. Before you start looking, create a “wants,” “needs,” and “must-haves” list. Consider if you want a “fixer-upper” or something “turnkey.” Knowing these things ahead of time will help you focus on the right homes and make a choice that’s best suited for you.

- A loan officer will assess your financial situation to determine what you can comfortably afford. They will show you different loan programs and help you find any grants you may qualify for. They will also get you pre-approved for a specific amount so you can shop for homes with confidence.

Let Us Help Take the Fear Out of Homebuying!

The journey to homeownership is exciting, and it’s normal to feel a little scared at first. But with the right knowledge and an expert team by your side, you can face these fears head-on and get the keys to your dream home.

Ready to take the first step? Reach out to us today to start your journey!