For many, homeownership is a cornerstone of the American Dream. But, as you embark on this exciting journey, a crucial factor often comes to the forefront: debt. Understanding how your existing debt – both good and bad – impacts your ability to secure a mortgage and purchase a home is essential.

Let’s look at how debt plays a role in your home buying power.

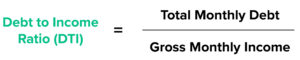

The Debt-to-Income Ratio

When you apply for a mortgage, lenders evaluate your financial health. A key metric they use is your debt-to-income (DTI) ratio. This ratio compares your total monthly debt payments to your gross monthly income. Essentially, it helps lenders assess your ability to manage additional housing payments on top of your existing financial obligations.

Generally, the lower your DTI, the more financial flexibility you demonstrate to a lender, often leading to better loan terms and a smoother approval process.

Understanding ‘Good’ vs. ‘Bad’ Debt When Buying a Home

Not all debt is created equal. Some forms of debt can be viewed positively by lenders, demonstrating responsible financial behavior and an investment in your future.

Student Loans

While they can be substantial, student loans are often seen as an investment in your education and future earning potential. As long as you’re making consistent, on-time payments and your DTI remains within acceptable limits, they typically don’t hinder your mortgage eligibility. In fact, they can contribute to a positive credit history.

Existing Mortgages

If you’re looking to buy a new home while still owning a previous one (perhaps as an investment property), your existing mortgage payments are factored into your DTI. However, demonstrating a history of timely mortgage payments on your previous property can show financial stability.

Car Loans:

A car loan, especially for a necessary vehicle, is a common form of debt. As long as the payments are manageable within your DTI and you have a good payment history, it’s generally not a red flag.

The key with “good” debt is consistent, on-time payments. This builds a strong credit history, a vital component of your mortgage application.

Alternatively, certain types of debt can negatively impact your ability to secure a mortgage. These often indicate higher risk for lenders.

High Credit Card Balances:

Carrying high balances on credit cards, especially close to your credit limits, is a concern for lenders. It may suggest financial strain and a potential inability to manage additional debt. High credit utilization can also significantly lower your credit score.

High-Interest Loans:

These types of loans are red flags as they indicate immediate financial distress and can trap borrowers in a cycle of high-interest payments, making it very difficult to afford a mortgage.

Collections:

Accounts sent to collections or charged off by creditors are severe negative marks on your credit report and will almost certainly impact your ability to get a mortgage until they are resolved.

Delinquent Payments/Defaults:

Missed payments or defaults on any type of debt are highly detrimental to your credit score and signal a high level of risk to lenders.

Feeling overwhelmed by your debt? Don’t let it stop you from your homeownership goals.

Contact one of our experienced Mortgage Loan Officers today to get a personalized plan and find out how we can help you on your path to homeownership.

Strategizing Your Debt for Homeownership

If you’re dreaming of buying a home, proactively managing your debt is key. Here are our Top 5 strategies to consider implementing:

- Reduce High-Interest Debt First:Prioritize paying down high-interest credit card balances. This frees up cash flow and improves your DTI.

- Make On-Time Payments: This cannot be stressed enough. Consistent, on-time payments across all your debts are fundamental to building a strong credit history.

- Avoid New Debt: Before and during the mortgage application process, avoid taking on new loans or making large purchases on credit.

- Check Your Credit Report Regularly: Obtain a free copy of your credit report from each of the three major credit bureaus annually (Equifax, Experian, TransUnion). Review it for errors and understand your financial standing.

- Consult a Mortgage Professional: A qualified mortgage loan officer can assess your unique financial situation, explain how your debt impacts your eligibility, and help you develop a personalized plan to prepare for homeownership.